Over a month ago when the government published the much-awaited e-commerce policy framework, it managed to bring the sector into the limelight, rekindling hopes of takeoff at last.

The document, after input from a range of stakeholders, had identified key challenges and recommended concrete measures that must be taken in order to fuel the economy’s digital engine.

However, e-commerce in Pakistan has often found people divided, which stems from the lack of trust the wide majority has in online shopping. While a few tech players, particularly those in ride-hailing, have managed to truly make a behavioural change among the masses, others have largely lagged behind with most of their takers from a certain social class or age group.

Facts and figures regarding the industry’s impressive growth, which was 93 per cent last year, are often quoted to suggest how the country is on its way to digital disruption. But even a cursory cross-sectional comparison with other developing countries reveals how uncovered the market still is. Our total e-commerce sales clocked in at Rs40.1 billion ($256 million roughly) in 2018. Contrast this with Egypt — often regarded to have similar macroeconomic dynamics as Pakistan — that posted revenues of $5bn. Iran generated $18.5bn despite having a crippling economy under the burden of sanctions.

E-commerce platforms don’t even have websites in local languages, thus making the English-speaking population the primary beneficiary of digitisation

Traction-wise too we were much behind, with the largest player by far, Daraz, managing to garner around 8m monthly visits versus 13m of Egyptian Souq and a whopping 44m of Iran’s Digikala — both the market leaders in their respective countries.

What could be the major factors hindering the growth? A noticeable difference between Pakistani e-commerce platforms and those of the above-mentioned countries is that the former don’t even have websites in local languages, thus making the English-speaking population the primary beneficiary of digitisation while the mass majority is largely left behind.

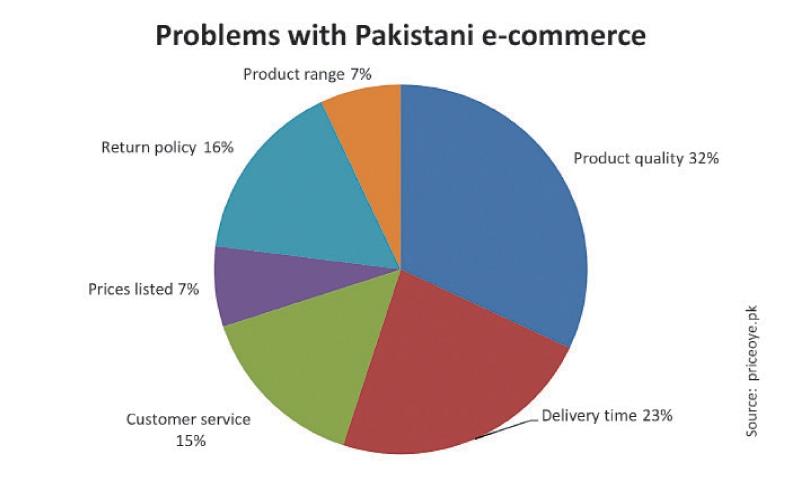

But let’s leave aside the underserved population for now, and focus on the served segment. A new report “2019 NPS Study of Local E-commerce” conducted by the Islamabad-based price comparison website, PriceOye.pk, takes a look at the major reservations of customers regarding online business.

Taking the widely used customer satisfaction metric Net Promoter Score — an index ranging between negative to positive 100 — they calculated the same for a number of Pakistani e-commerce websites (both marketplaces and retail) as well as some of the major verticals such as ride-hailing and food delivery.

In essence, the indicator measures the likelihood of a customer recommending a certain product/service to someone else on the scale of 1-10. Those giving a score between zero and six are classified as detractors, seven and eight as passives while nine and 10 are considered promoters. The final value is calculated by subtracting the percentage of detractors from that of promoters, with the scale tipped towards the positive obviously being desirable.

The study takes into account seven major e-commerce stores plus the ‘others’ category and finds the overall industry average at 9.6.

This negatively skewed indicator was led by the market leader itself with Daraz’s NPS coming in at -27, which was contributed by 25pc of customers expressing dissatisfaction over production quality, and 18pc each for customer service and return policy. Meanwhile, 32pc were pleased with delivery time, which could be due to the company’s not-so-old express services.

Goto.pk recorded NPS of -6.7, driven by 33pc of buyers not happy with price accuracy while 38pc approved of the product quality. On the flip side, the score of Mega.pk was 10, thanks to the company getting a nod from 50pc of the surveyed customers on product quality.

HumMart — the youngest entrant to the lot — had an NPS of 14, ShopHive 16 and iShopping.pk 20. Meanwhile, HomeShopping — one of the oldest players in the scene — registered a value of 23, highest among all operators but below the clustered ‘others’ (at 26), which included sellers over Facebook and Instagram.

Among other online verticals — including shoes, food delivery, classified, ride-hailing, fashion, ticketing and make-up — the NPS was 11.4 with values ranging from negative 30 in shoes to positive 64 in make-up.

In between were the three relatively mature yet negatively tilted industries. According to the report, ride-hailing NPS was -27 owing to a score of -57 for Uber while Careem and Bykea had values of 50 and 40, respectively.

Food delivery’s NPS stood at -10, with promoters mostly being those who had ordered directly from restaurants’ websites while customers using aggregator portals, mostly Foodpanda, complained about delivery and payment reversal durations. Classified business — that has the likes of home-grown PakWheels and Zameen plus the global giant OLX — had an aggregate NPS of -9, with most promoters coming from the cars website.

Obviously none of this should be taken as gospel but all these metrics — from basic analytics to customer satisfaction proxies — do suggest something’s not right. Surely, the lack of policy hindered the sector’s growth. But it can’t possibly explain why a certain company is unable to keep its customers happy with regards to, say, product quality or customer service.

Is the issue more operational or structural? “It’s kind of a chicken-and-egg problem: lack of structural incentives acts as a barrier to entry which, in turn, affects the former,” Daraz Managing Director Ehsan Saya tells Dawn.

To put its own house in order at least, the company has introduced in-house delivery, Daraz Express, and a closed-loop wallet. “Payments and logistics are the biggest challenges in e-commerce, which we have been able to address greatly since these two measures,” he explains. As for the biggest customer irritant, product quality, the managing director says they have a Daraz university for seller education, which will eventually help tackle that front.

Above all, it’s the general trust deficit in e-commerce, which needs not only a proactive leader but also conducive policy. Whether recent developments on both fronts will be able to bear fruit remains to be seen.

Published in Dawn, The Business and Finance Weekly, November 4th, 2019